Staying Grounded in a Shifting Market

If you’ve glanced at the headlines lately, you’ve probably seen words like “slump,” “slowdown,” or “uncertainty.” It can feel unsettling. But step back for a moment: every economy goes through cycles. Just as the seasons change, markets shift, offering both challenges and opportunities. When we look at the bigger picture, there are many reasons to remain optimistic.

Global Resilience and Signs of Stability

Despite bumps along the way, global markets have shown strength this year. Canadian stocks reached new highs, while U.S. and international markets have posted impressive gains.

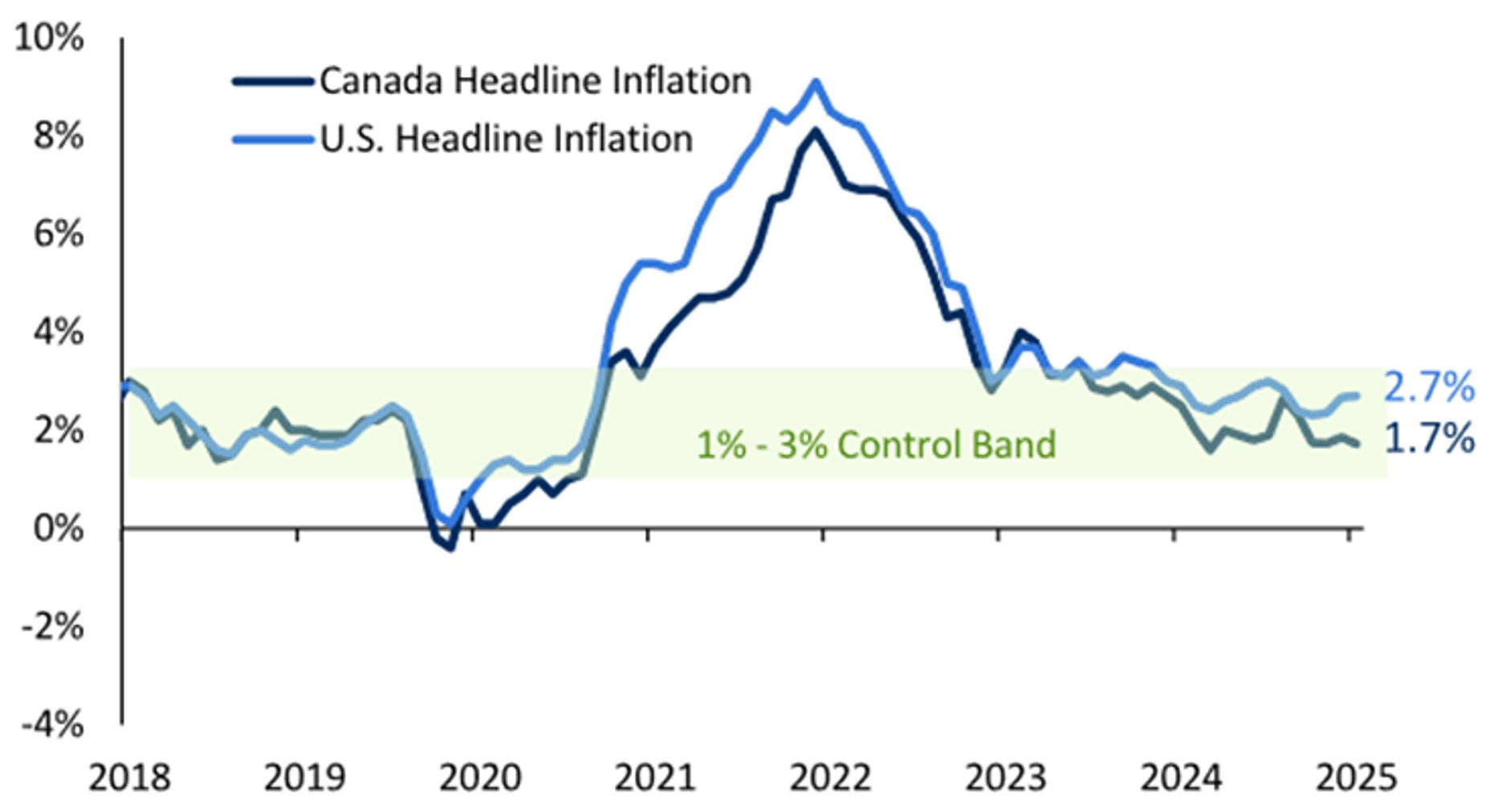

Canada’s economy did contract slightly in the second quarter, but that’s not the full story. Domestic demand—the spending and investment that happen within our own borders—remains solid. Household consumption is up, housing activity is recovering, and inflation has cooled to below target. These are encouraging signs that the economy has breathing room to grow.

Yes, the unemployment rate ticked higher to 7.1%. But even here, context matters: the average rate since 2005 has been about 6.2%, so today’s numbers are still within a normal range. And with softer labour data, the Bank of Canada now has room to continue to lower interest rates, which could give both businesses and households a welcome boost.

South of the border, growth has been stronger than expected thanks in part to investment in technology and artificial intelligence. Corporate profits are rising, and most companies are exceeding earnings expectations. Europe and emerging markets are also showing resilience, with strong equity performance despite trade concerns.

Looking Ahead

Bank of Canada’s recent lowered bank rate combined with resilient consumer demand and strong corporate earnings, creates a supportive environment for investors.

The takeaway? While short-term shifts may feel dramatic (and are often exaggerated and out of context in the media), the long-term outlook remains constructive. Staying grounded, optimistic, and focused on your personal savings and investment goals can help you navigate change with confidence.